Value drivers •Agency problem –Shareholder’s interests versus. Long-term value creation Alfred Rappaport prescribes ten Basic Governance Principles a company adopt for long-term shareholder value creation. 32 Principles of Shareholder Value Creation. Principles of Shareholder Value Creation Carry assets only if they maximize value. High returns do not always create value. Return on high risk investment. High-level Drivers of Shareholder Value. Alfred Rappaport prescribes ten Basic.

Nov 20, 2012 Canada ices-003 class b motherboard drivers download. Manufacturer and model and then download drivers from the manufacturer's website. Howardmac Honorable. Nov 16, 2012 15 0 10,510 0. Nov 20, 2012 #3 shefeershahul007: where will get canada ices 003 class b drivers? My driver cd is gone.

Nov 20, 2012 Canada ices-003 class b motherboard drivers download. Manufacturer and model and then download drivers from the manufacturer's website. Howardmac Honorable. Nov 16, 2012 15 0 10,510 0. Nov 20, 2012 #3 shefeershahul007: where will get canada ices 003 class b drivers? My driver cd is gone.

• Investors can earn superior returns by reading the price-implied expectations in stock prices and correctly anticipating revisions in those expectations. • provides the tools investors need to read expectations and anticipate revisions of those expectations by manipulating the traditional discounted cash flow model, and by bridging the gap between valuation and competitive strategy. Overview and Thoughts:, provides investors with a fantastic framework upon which to make critical investing decisions. The book is a quick read, and the core concepts are relatively straightforward to apply, especially for investors with previous valuation experience. It’s critical today to be able to understand what expectations are embedded in a stock’s current price (what’s priced in?), and this book provides a useful set of tools to estimate these price implied expectations. One question I always ask in my personal investing process is, how does the market view my target?

Expectations Investing also bridges valuation (through the expectations investing framework) with competitive strategy analysis and the evaluation of management decisions. Part 1: Gathering the Tools Chapter 1: The Case For Expectations Investing The authors argue that investors can achieve superior returns by reading the expectations that are currently embedded in the price of a stock, and correctly anticipating revisions in those expectations through competitive strategy analysis, and by reading management signals.

Wincalendar 4 serial killer. Active investors have underperformed for a variety of reasons including but not limited to: costs, incentives, style limitations, and ineffective tools. The expectations framework doesn’t distinguish between styles like growth or value, leads investors to reduce the number of trades they make, and provides them with the correct tools they need to succeed.

Here are the three steps in the expectations investing process: • Estimate price-implied expectations (using a reverse DCF model) • Identify expectations opportunities (where the company is most sensitive to revisions in expectations, ie. Sales, costs, investments) • Make a buy, hold, or sell decision Chapter 2: How the Market Values Stocks Research shows that despite popular belief that the market is short-term, it actually values stocks based on the magnitude, timing, and riskiness of long-term expected cash flows. In order to understand what expectations are implied in a stock price, investors need to understand a few key concepts: • How to get from a company’s financial statements to free cash flow • The time value of money and the relationship between discounting and compounding (here’s a cool visual from ) • Traditional DCF analysis The expectations investing framework uses the future free cash flow performance implied by the stock price as a benchmark for decision making. The author’s argue (and I would agree) that this is a lot more useful than either struggling to forecast these future cash flows, or using poor short-term valuation proxies like P/E ratio’s.

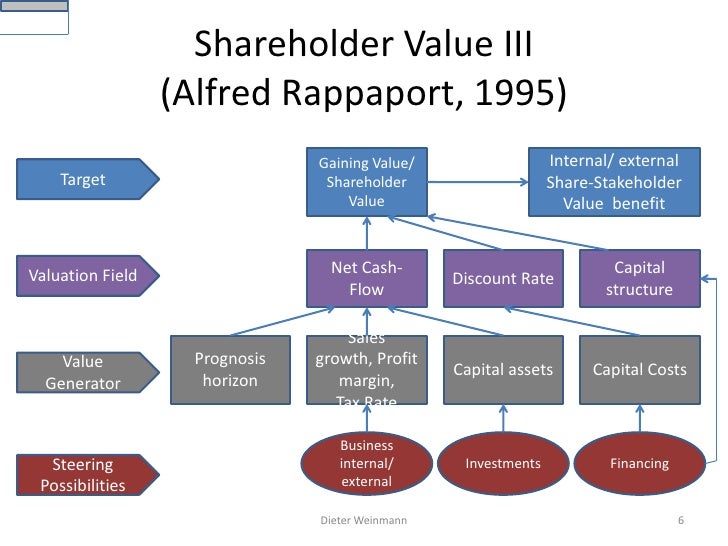

Chapter 3: The Expectations Infrastructure In order to correctly anticipate revisions in expectations, investors need to understand the framework of what drives shareholder value. The author’s detail the relationship between value drivers, (influenced by) value factors, (influenced by) and value triggers. The three main triggers are sales, costs efficiencies, and investment efficiencies, and you can determine the influence that changes in each of these areas will have on the price of a stock by tinkering with them in your model. Investors should focus on the area with the largest expectations revision potential, which is usually sales.

Latest Posts

- Windows 7 Ultimate Gvlk Klyuchica

- K Elize Noti Dlya Fortepiano S Applikaturoj

- Cisco Packet Tracer Projects Examples

- Game Motogp 2014 Pc Full Version Single Link

- Reclaime File Recovery Ultimate Keygen Software License

- Kirgizcha Lirika Sujuu Zhonundo Tekst

- 1000 Lugares Que Ver Antes De Morir Pdf Descargar Gratis

- Vin To Pin Keygen Software

- Mass Effect 2 Shadow Broker Dlc Pc Download

- Skripsi Demam Berdarah Dengue Pdf Espaol

- Prablema Geraizmu I Podzvigu U Apovesti Znak Byadi V Bikova

- Teac Cd P3500 Service Manual

- Download Kendrick Lamar Section 80 Zip File

- Free Download Program Sergio Mendes Arara Rar File

- Digital Pipe Fitter Keygen Generator Ableton